Insights & News

Check out the links below for related multifamily real estate content,

recommended readings, podcasts, and more.

From the Desk of the CEO

Here we go again! Ready or not, welcome to the second presidency of Donald Trump, often known as the real estate “Developer-in-Chief”. Regardless of one’s political beliefs, it’s undoubtedly interesting and exciting to have a real estate industry professional (back) in the White House.

From the Desk of our CEO

It has been an exciting time for interest rate “junkies.” Those following the Federal Reserve’s moves have likely been busy speculating and making bets on impending moves by the Fed.

The recent rate cuts beg the question: do the rate cuts actually affect real estate investments, and if so how? Investing in real estate successfully requires utilizing leverage...

From the Desk of our CEO

Unless you’ve been living under a rock (and even if you have, have you seen the cost of rocks these days? ;)) the current high-inflation economic environment has likely impacted you. From the high cost of groceries and gas to insurance and travel, prices on just about everything have skyrocketed, impacting nearly every aspect of our lives...

From the Desk of our CEO

A friend of mine, who also happens to be a Park Row Equity Partners investor, recently joked with me that I suffer from “TMP”. This startled me for a brief moment. Was this some sort of ailment I hadn’t heard of? “Too Many Properties” he declared, and we laughed together.

This particular individual is invested in four of our properties, and we couldn’t remember the name...

From the Desk of our CEO

This time of year often comes with a lot of self-reflection.

It's been a particularly reflective time for me given that LinkedIn reminded me that I'm celebrating 35 years with Park Row South Realty and its subsidiary Park Row Equity Partners (PREP): 35 years?! That's four years short of four decades, and sure sounds like a long time...

From the Desk of our CEO

I write this letter with a very heavy heart, filled with extreme pain and sadness over the recent horrific and brutal terrorist attacks on our brothers and sisters in Israel. As you will read when you scroll below, the PREP team has supported several organizations, and we intend to continue to do whatever we can to help.

Key Concepts

Internal Rate of Return (IRR)

When assessing a multifamily investment opportunity, a metric which is important to analyze is the Internal Rate of Return (IRR).

Often, IRR is used interchangeably...

Capital Expenditure

Whether you invest in stocks, bonds, startups, private equity, treasuries, or you guessed it, multifamily real estate, all investing comes down to one fundamental objective: to sell your asset at...

Absorption Rate

Among other important metrics often used when analyzing a real estate investment property, it is essential for an investor to review and understand the Absorption Rate (AR) (Occupancy Rate)...

Long-Term Investing

Real estate is known to be a long-term hold investment. What is a long-term hold and are there tradeoffs to holding an investment longer term? Why can't I buy and sell my shares quickly...

K-1 Tax Document

Tax season is right around the corner, and that means one thing–it’s time for the most popular investor question of the season: “Where is my K-1?” Let's take a deep dive into understanding the...

Depreciation

The benefits of real estate appreciation are well-known; a property increases in value over time, and the investors of that property enjoy the benefit of the value increase. But, what about depreciation?...

Net Operating Income

When prospective real estate deals are evaluated, it is important to continuously monitor the Net Operating Income, or NOI. It is the key value on the financial statement that indicates whether a property...

From the Desk of our CEO

Unless you’ve been living under a rock (and even if you have, have you seen the cost of rocks these days? ;)) the current high-inflation economic environment has likely impacted you. From the high cost of groceries and gas to insurance and travel, prices on just about everything have skyrocketed, impacting nearly every aspect of our lives...

Internal Rate of Return

When assessing a multifamily investment opportunity, a metric which is important to analyze is the Internal Rate of Return (IRR).

Often, IRR is used interchangeably with Return on Investment (ROI)...

Capital Expenditure

Whether you invest in stocks, bonds, startups, private equity, treasuries, or you guessed it, multifamily real estate, all investing comes down to one fundamental objective: to sell your asset at...

Absorption Rate

Among other important metrics often used when analyzing a real estate investment property, it is essential for an investor to review and understand the Absorption Rate (AR) (Occupancy Rate)...

Long-Term Investing

Real estate is known to be a long-term hold investment. What is a long-term hold and are there tradeoffs to holding an investment longer term? Why can't I buy and sell my shares quickly...

K-1 Tax Document

Tax season is right around the corner, and that means one thing–it’s time for the most popular investor question of the season: “Where is my K-1?” Let's take a deep dive into understanding the...

Depreciation

The benefits of real estate appreciation are well-known; a property increases in value over time, and the investors of that property enjoy the benefit of the value increase. But, what about depreciation?...

Net Operating Income

When prospective real estate deals are evaluated, it is important to continuously monitor the Net Operating Income, or NOI. It is the key value on the financial statement that indicates whether a property...

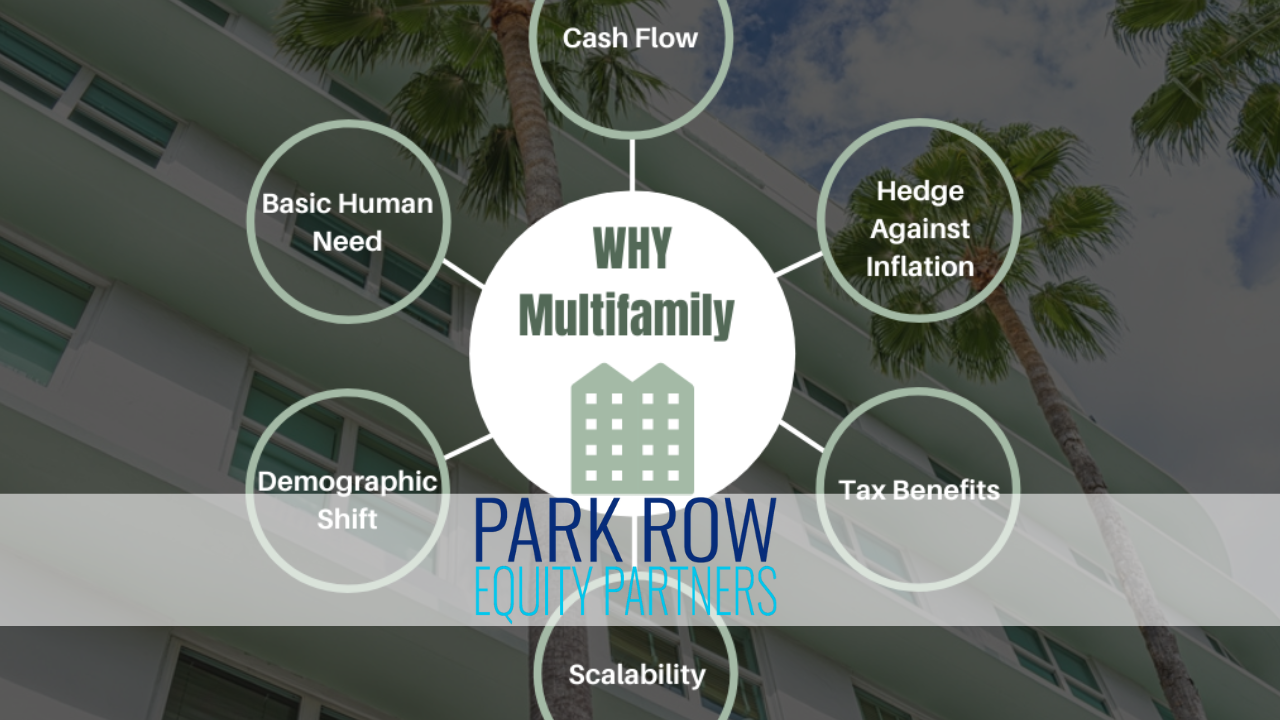

More Baby Boomers Find They Enjoy Renting

A growing number of Baby Boomers now believe that it's better to rent than to buy a home in the current environment, with 80% on board, up from 63% a year ago, according to a report from Bank of America.

Globest.com By Richard Berger | May 17, 2024

Articles

U-Haul Growth States of 2024

The trend of southern states netting larger numbers of one-way U-Haul® customers continued during 2024, with South Carolina topping the U-Haul Growth Index for the first time.

Finance.yahoo.com By Jeff Lockridge | January 2, 2025

More Americans Rent Long-Term

Why do people choose to rent? In some cases, it may be because they have not decided to make a city their permanent home. In others, it may be because the cost of homeownership is a barrier.

Globest.com By Philippa Maister | November 21, 2024

Three Reasons Multifamily Demand is Soaring

Multifamily demand is soaring, reaching 362,000 units during the first three quarters of 2024 and exceeding all full years studied by Cushman & Wakefield other than 2021.

Globest.com By By Kristen Smithberg | November 20, 2024

Multifamily Boom

Apartment rents are stagnating, but multifamily construction is booming, creating a widening split in the U.S. housing market. According to a new Redfin report, renter households rose by 2.7% in Q3 to 45.6 million...

Globest.com By Mario Marroquin | November 7, 2024

Demographic Trends

Housing demand in the United States will continue to benefit from demographic trends, according to a RealPage analysis incorporating several layers of data.

Globest.com By Kristen Smithberg | October 7, 2024

More Renters Are Staying Put Longer

Multiple factors are leading renters to remain in place for longer periods of time... It found that one in six renters stayed in their home for 10 years or more in 2022, up from 13.9% a decade earlier.

Globest.com By Erika Morphy | June 03, 2024

Bad News for Homebuyers

New housing units are not keeping up with the growth of U.S. families, leaving the nation with a shortage of homes that is growing year over year and driving the housing affordability crisis.

Globest.com By Kristen Smithberg | June 21, 2024

U-Haul Growth States of 2024

The trend of southern states netting larger numbers of one-way U-Haul® customers continued during 2024, with South Carolina topping the U-Haul Growth Index for the first time.

Finance.yahoo.com By Jeff Lockridge | January 2, 2025

More Americans Rent Long-Term

Why do people choose to rent? In some cases, it may be because they have not decided to make a city their permanent home. In others, it may be because the cost of homeownership is a barrier.

Globest.com By Philippa Maister | November 21, 2024